Some interesting stats on divorce

I've always joked "Nobody in my family gets married, only divorced" when I used to confess I'd never been to a wedding until I think I was 24. Being in my late 20's now, I've certainly been to plenty of weddings in the past few years, but as each year passes that I remain single I still wonder how much of that is me, bad luck, bad timing, related to my extended family's checkered history with marriage, or some combination of each. In this Sunday's Globe Magazine, Lindsay Tucker wrote an essay titled "Am I doomed to divorce" that definitely touched on many things I've thought about myself. I was very interested in some facts she quotes from divorcerate.org (see chart below) which shows a 50% improvement on divorce rate for men who wed after the age of 30 (compared to 25-29). That's good news for me seeing as I sure as hell won't be married before age 30.

Age at marriage for those who divorce in America

| Age | Women | Men |

| Under 20 years old | 27.6% | 11.7% |

| 20 to 24 years old | 36.6% | 38.8% |

| 25 to 29 years old | 16.4% | 22.3% |

| 30 to 34 years old | 8.5% | 11.6% |

| 35 to 39 years old | 5.1% | 6.5% |

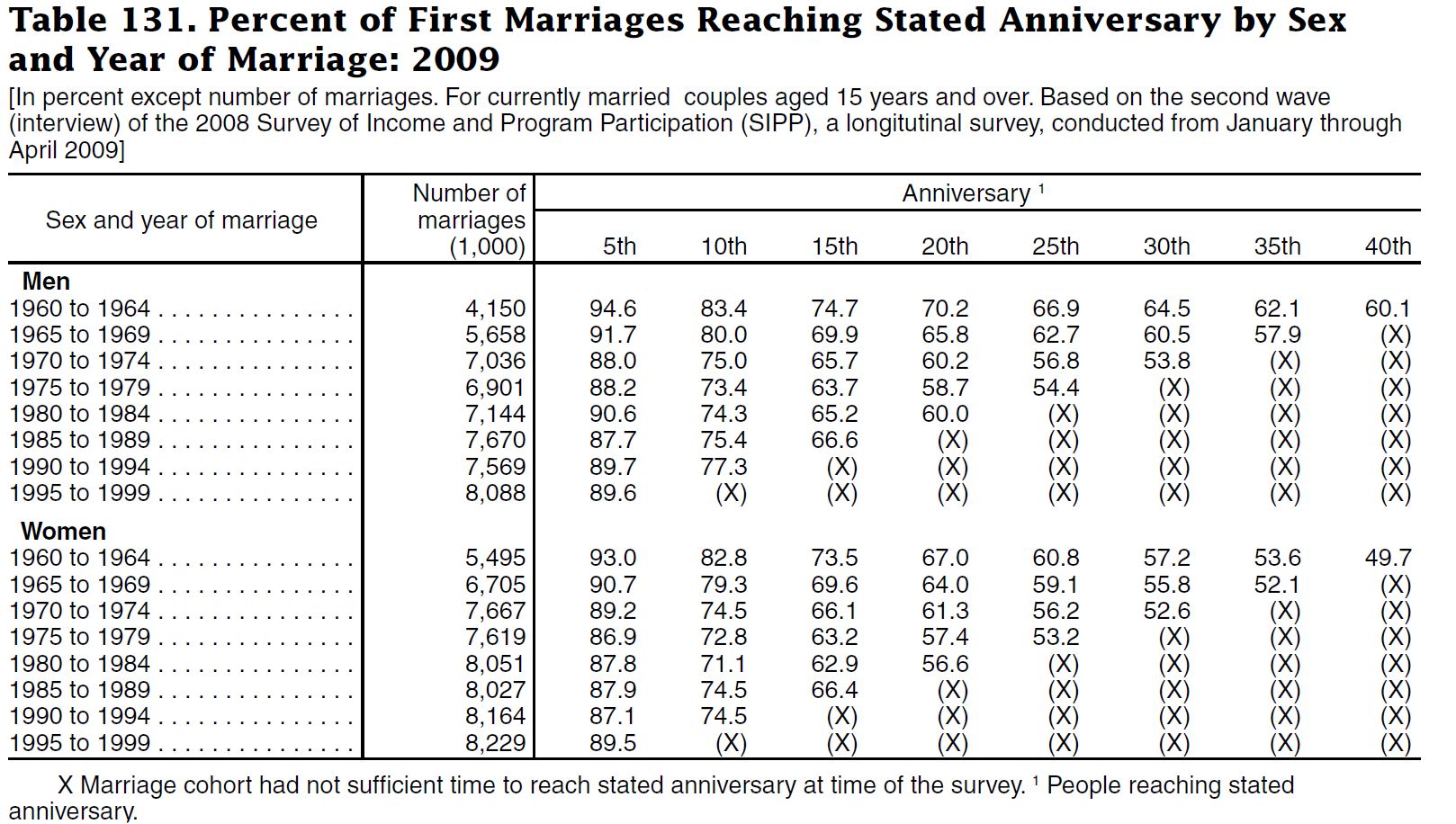

Digging into the facts a little more (divorcerate.org seemed like a really questionable source since most of the site looked to be paid advertisements and no sources were given), I came across some US Census #'s which do show that the 50% divorce rate over time is more or less true. See table 131 at this link which shows only 60% of men reaching their 40th wedding anniversary and 50% of woman doing so. Census Study published in 2011 found here.

It's also interesting to learn that the generally more conservative Southern and Western states have the highest divorce rates (likely because of marrying earlier and having less education on average). I would love to do a Red State/Blue State mashup of this data. My home state of Massachusetts had the lowest rate in the country at 1.8% -- score a 2nd point for my future prospects.

Top 10 state divorce rates:

Source (Wall Street Journal)

|

Nevada

|

6.6

|

|

Arkansas

|

5.6

|

|

Wyoming

|

5.2

|

|

West Virginia

|

5.0

|

|

Idaho

|

5.0

|

|

Oklahoma

|

4.6

|

|

Kentucky

|

4.6

|

|

Alaska

|

4.4

|

|

Maine

|

4.3

|

|

Florida

|

4.3

|

Sweet product warranty

Here's the amusing warranty from my new Skullcandy headphones I bought for running today. I didn't see this until I got home, but now I'm confident I made a great choice.

LIMITED LIFETIME PRODUCT WARRANTY - Skullcandy is proud to provide the best product warranty in the industry. If this product should fail in your lifetime, we will replace it at no charge. If the product is damaged by aggressive music listeners sliding a rail, sliding down the emergency ramp of your aircraft, slammed in your locker, slammed in your car door, run over by a car, running into a wall, getting run out of town, mountain biking, road biking, sky diving, beating your boyfriend unmercifully, getting beat down by the man, blown up in an accidental experimentation with flammable substances, or damaged in any other every day experience, it means you are living your life the way we want our product used! In these, or in any other damaging events, we will replace the product for a 50% discount from retail. Love Skullcandy.

It's very cool when a company stands by its products, hopefully these will last longer than my last pair. I do find it very interesting that a company can get away with writing "beating your boyfriend unmercifully". Imagine the uproar if they switched boy with girl?

Don't Mess with Texas!

Texans sure are proud of their state, but with Rick Perry putting it in the spotlight and many in depth articles being written about its policies lately, I can only hope that our country learns from their mistakes and doesn't mess with Texas and Perry. The Boston Globe had an interesting (but long, read here) article today on the state of medical coverage and care in Texas. Almost 1 out of 3 working age adults (32%) in Texas have no health insurance, compared to 7% in Mass and 22% in the US. In addition, 16.8% of children 18 and under have no insurance. Overall, Texas has the highest rate of uninsured people in the country (24.6%), a number which has grown by 35% in the 11 year tenure of Rick Perry.

So what is Texas doing about all of this? Cutting funding and getting fatter! According to the Globe article, in the last legislative session that ended in May, the state cut two thirds of the funding for women's health clinics and underfunded Medicaid by almost $4 billion, in addition to cutting hospital reimbursements. With Texas trending to providing less preventative care and service availability and also getting more and more obese each year, things do not look good.

Our healthcare system is such a mess

Ever have to pay for something, and I emphasize something because you don't really know what you are paying for, which has two different prices (neither of which are told to you up front), and both of which are excessive? That's reality for many Americans today and is why our healthcare system is such a mess. Imagine this: you get into a car accident that is your fault and you have to go to the auto repair place. You have a $1500 deductible, but thankfully it isn't bad and likely won't cost that much. The auto repair place says that they will fix your car, but they will charge you to look over the damages and then you will have to bring it in a few times in order to repair it completely. You ask how much it will cost, they say they don't know. You ask your insurance company, who has told you to go to this "preferred" repair place, and they have a website that says repairs like this typically cost $25-30 each time you visit. So, you bring your car in for a "diagnostic" visit, where they ask you a few questions about your car and take a quick look before sending you on your way 30 minutes later, telling you to return in 2 weeks. A week later you get a bill for $220. You show up 2 weeks later to your 2nd appointment, they repair the first part of your car and again tell you to return in 2 weeks. A week later you get a bill this time for $200, but learn that the "contract rate" for your first appointment will be $120 instead of $220. When you ask why a 30 minute appointment costs $120 (or $220), nobody knows. When you ask how much you'll end up paying for your $200 appointment, again, nobody knows. When you ask how much you would have paid if you had gone to the guy down the street, nobody knows. When you ask why the insurance website estimates each appointment would be $25-30, nobody knows.

As bizarre as this whole situation would sound for a car repair, this is actually how my "High Deductible" health insurance plan works. The current health care billing system is clearly broken, this behaves so much differently than almost any other industry yet somehow they get away with it. I signed up for this plan in 2011 because I had a financial incentive to do so, and because I was a little curious about how this would all pan out especially since at the time the health care debate was all over the news.

So what have I learned? The idea of moving away from the "open bar" of most HMO's to a "cash bar" of a high deductible plan I honestly believe is the ticket to fixing health care in this country. Just knowing the cost of an appointment or treatment is enough to make one "shop around" or at least make sure they truly need to be treated. Removing ALL costs or deductibles from any "preventative care" is also a key element, as it encourages regular checkups to prevent issues from going undetected. With that said, in order for a system like this to work well, there are many areas that first need to be improved and I have been less than satisfied with my experience thus far (although most likely I will have saved a significant amount of money this year over an HMO).

With only a minor injury requiring some basic physical therapy and a few visits to a chiropractor (not a complex issue such as a serious illness or undiagnosable symptoms), I've observed the following:

- Each doctor you visit can tell you how much they bill for each service, but they don't know what service they will bill you and they don't know what the "contract rate" the insurance company has negotiated for each service which you will end up paying. So the doctor bills a "MSRP", the insurance company turns around and tells its customer they only have to pay the sale price, which is 50% off the MSRP for this service and 35% off for that service

- The insurance company knows the contract rate, but they don't know the "service code" that the doctor will bill, so they can't tell you how much something will cost or where the cheapest and best qualified doctor in the area is.

- The insurance company "cost estimator" must be accurate and easy to use. If someone isn't able to "shop around" and select a provider that has a good track record of service and affordable prices, this system will fail. After all, that is the whole point, to allow one customer to go for the top shelf tequila and another to go for the "well" tequila

- The cost that someone without insurance pays for a basic service is excessive. In my case, a 30 minute "diagnostic appointment" with a physical therapist (keep in mind I already had a diagnosis from my doctor of what was wrong) would have cost me $220 if I had no insurance, instead of the $120 i actually paid. I can only imagine what it would cost if I had a serious injury